Ogier’s At a Glance Guide to BVI Wills for non-doms

02 April 2024

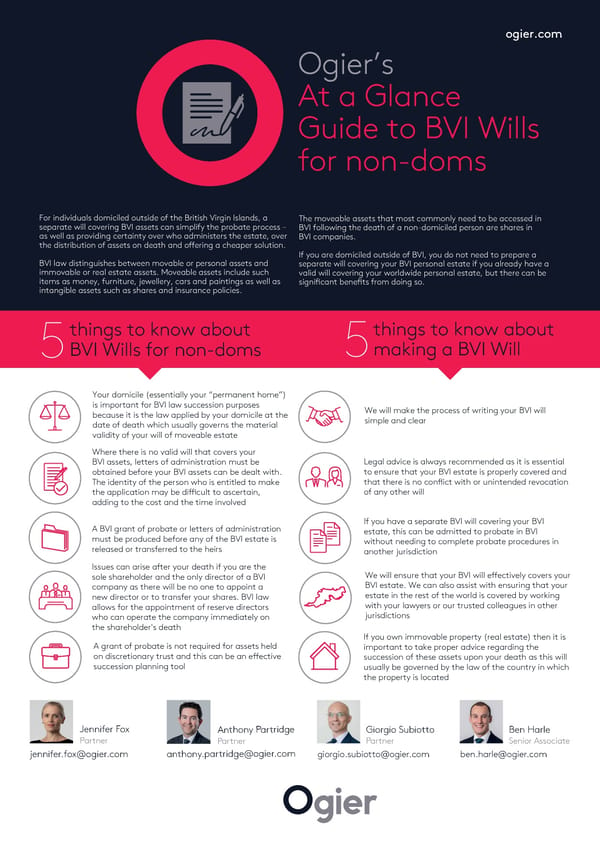

ogier.com Ogier’s At a Glance Guide to BVI Wills for non-doms For individuals domiciled outside of the British Virgin Islands, a The moveable assets that most commonly need to be accessed in separate will covering BVI assets can simplify the probate process – BVI following the death of a non-domiciled person are shares in as well as providing certainty over who administers the estate, over BVI companies. the distribution of assets on death and o ering a cheaper solution. If you are domiciled outside of BVI, you do not need to prepare a BVI law distinguishes between movable or personal assets and separate will covering your BVI personal estate if you already have a immovable or real estate assets. Moveable assets include such valid will covering your worldwide personal estate, but there can be items as money, furniture, jewellery, cars and paintings as well as signi cant bene ts from doing so. intangible assets such as shares and insurance policies. things to know about things to know about BVI Wills for non-doms making a BVI Will 5 5 Your domicile (essentially your “permanent home”) is important for BVI law succession purposes We will make the process of writing your BVI will because it is the law applied by your domicile at the simple and clear date of death which usually governs the material validity of your will of moveable estate Where there is no valid will that covers your BVI assets, letters of administration must be Legal advice is always recommended as it is essential obtained before your BVI assets can be dealt with. to ensure that your BVI estate is properly covered and The identity of the person who is entitled to make that there is no con ict with or unintended revocation the application may be di cult to ascertain, of any other will adding to the cost and the time involved If you have a separate BVI will covering your BVI A BVI grant of probate or letters of administration estate, this can be admitted to probate in BVI must be produced before any of the BVI estate is without needing to complete probate procedures in released or transferred to the heirs another jurisdiction Issues can arise after your death if you are the sole shareholder and the only director of a BVI We will ensure that your BVI will e ectively covers your company as there will be no one to appoint a BVI estate. We can also assist with ensuring that your new director or to transfer your shares. BVI law estate in the rest of the world is covered by working allows for the appointment of reserve directors with your lawyers or our trusted colleagues in other who can operate the company immediately on jurisdictions the shareholder's death If you own immovable property (real estate) then it is A grant of probate is not required for assets held important to take proper advice regarding the on discretionary trust and this can be an e ective succession of these assets upon your death as this will succession planning tool usually be governed by the law of the country in which the property is located Jennifer Fox artridge Giorgio Subiotto Ben Harle P y thon An Partner artner Partner Senior Associate P .com .partridge@ogier y [email protected] [email protected] thon [email protected] an